Adsterra is an advertising network used by more than 30K publishers and advertisers globally. Provides you with a user-friendly platform with high and quick rewards, handy statistics, and a tracking system. It provides you with special offers that have higher payments and unique conditions for every affiliate. We work with multiple client partners (QBO, Gusto, Bill.com, Expensify, Concur, Rippling, etc). So you don’t have to sweat if you’re using software that’s other than QuickBooks.

It’s a plus if you can find a certified public accountant that has extensive experience in your industry since they already know the ins and outs of what makes a startup successful. Your structure will depend on your business goals, financial need, personal risks, and liabilities. That’s why it’s a good idea to discuss each option with your certified public accountant to determine which aligns with your business objectives the most.

A good CPA can put your startup on the path to financial success

They’ll also keep up with the latest tax law changes, so they should be able to let you know if the adjustments will affect your startup. In the world of affiliate marketing, Refersion is a cutting-edge platform that streamlines network management, analytics, and expansion. Adsterra is trusted by 30K+ advertisers and publishers all over the world because it offers full-fledged support throughout your advertising campaign. Armed with these powerful strategies, you can confidently navigate the dynamic business world, setting a strong foundation for growth and prosperity in your new venture.

For the first, most VC-backed startups will go through complicated financial due diligence during a funding round or during an M&A exit to a large technology player. Later-stage VCs are increasingly hiring outsourced due diligence experts – including large accounting firms. The team at a huge accounting firm that is investigating your startup’s financials will have pages upon pages of questions. Having a CPA who knows your company and financials (and tax returns) on your side will make due diligence that much easier and less painful.

Stash’s Favorite Tools

A business plan can help you structure a business goal and strategy for achieving it. Collaborating with a CPA can help you determine the viability of your business and make your goal more realistic since they can calculate financial data. Moonpull is a new affiliate tracking business that offers specialized advising to assist clients in maximizing the effectiveness. This is a great starting point for those who wish to venture into affiliate marketing on their own. Mailchimp is the All-In-One integrated marketing platform for small businesses, to grow your business on your terms.

Founder’s CPA has deep industry expertise on three industries in the startup space. This unique focus allows our team

to provide our clients with unparalleled support as their business scales. Although you can change your startup’s legal structure in the future, there’s still a risk it can lead to business and legal complications, like disorganization and tax consequences, if you’re not careful. To apply, please visit the startup accelerator program page at aicpa-cima.com/accelerator.html.

Did You Consider This Before Choosing Payroll Services for your Startup?

The AICPA and CPA.com Startup Accelerator helps grow startups throughout the accounting ecosystem so the innovators and cutting-edge solutions can help transform the profession. Our aim is to strengthen the ability of individual accountants and finance teams to be the go-to analysts, strategists and consultants that are indispensable to organizations across the globe. CPAs are highly qualified accountants, but if they don’t have experience with the precise requirements of your business, they could overlook important regulations or leave money on the table. To avoid these issues, the startup community should look for these five criteria when hiring a startup CPA. Early-stage companies are not all the same – a SaaS business is very different from a biotech company, and a hardware company is not at all similar to an ecommerce company. Some CPAs are specialized in particular verticals – ours is high-growth, VC-backed companies.

- If all you need for now is someone to track your monthly financials, paying CPA rates for bookkeeping duties may not be cost-effective for you.

- If you don’t legally need an audit but would still like an analysis of your financial records, you can opt to instead have a review, which is considered a moderate level of assurance.

- This way, you’ll be generating more revenue than you’re spending on acquiring new customers.

- Is all your energy going toward getting your product or service to the marketplace?

- They’ll be able to keep it organized and accurate so you’ll have time to focus on other aspects of your startup.

During your free consultation, ask for details about their contact hours and average response time to gauge how they’ll deal with time-sensitive accounting requests. If your CPA is slow to respond, or you find yourself continuously reaching out to get an answer to a question, then you should move on. Is your early-stage company located in cities like New York or San Francisco where regulatory and public policy are more complex? If so, your CPA needs to be on top of filing deadlines and government paperwork.

FUTA Tax 101: What Is It and How It Can Impact Your Small Business

Your startup may be bootstrapped or must have been through a friend and family around, so money is something you need to spend very judiciously. So many startups continue to handle accounting themselves because many cannot afford a full-time CPA. Thus keeping the startup in mind, it’s best to look for services that charge you monthly. It’s better to find a service provider rather than hiring a full-time CPA in-house because paying them a full-time salary, health benefits, and other things will be very expensive.

Quiz: Test your knowledge of famous scams and shams – CPA Canada

Quiz: Test your knowledge of famous scams and shams.

Posted: Tue, 15 Aug 2023 19:25:27 GMT [source]

Your CPA won’t perform tests or examine any internal controls, but will do a cursory check of your company’s financial statements to ensure there aren’t any obvious issues. During this process, your CPA can make inquiries, perform physical inspections, verify balances, and run other tests to confirm your financial statements are free from material misstatements. These number gurus are considered one of the most essential professionals to small business owners.

CPAs specializing in forensic accounting assist with disputes or litigation. They can calculate losses and economic damages for an insurance claim or breach of contract lawsuit, value a business as part of a dispute between business partners, and even search for hidden assets in a divorce case. That said, it is essential to follow a criteria checklist to find a CPA that matches you and your business goals. A Certified Public Accountant will be held to a different level and be asked to uphold specific professional standards under a strict code of ethics.

Any person who does any accounting functions is technically an accountant, even if they do not have a college degree. However, a CPA or Certified Public Accountant is someone who has earned a professional designation through the combination of education, licensing, and years of experience. Thoughtful planning has shown us that time and time again that it is essential to success! Not only that but when we burn out at our jobs, doing everything that needs to be done in a day ourselves. Eventually, our bodies, brains, and businesses will suffer from that as well.

If your startup needs financial assistance, your CPA can also assist you in processing loans or bank financing. While if you’re ready to expand, they can also help you process real estate acquisitions or phantom stock agreements. If you need help with tax planning, they can also assist you with optimizing exemptions while staying compliant. For efficiency, they can also set up accounting software so it’s easier to keep up with your records and minimize errors. If you opt for a cloud-based one, you can access your financial data anytime and anywhere in real time.

It’s important to note that there’s no right or wrong way to calculate CPA. An Overview of START-UP NY, QETC, and Life Sciences R&D Tax Credit Program New York has long been a global hub for finance, fashion, and food. But the Big Apple is also a budding hotspot for biotech, offering a robust range of programs designed to foster… We schedule ongoing video calls with you to review your financials and ensure all of your tax compliance is taken care off. Although they’re both numbers-related, bookkeeping and accounting are not the same. There’s no one-size-fits-all approach to finding the right CPA for your startup.

Criteria To Pick The Best CPAs For Startups

Launching a startup can be an exciting and daunting experience, especially for first-time founders. Profit and funding play a vital role in the early days of your venture, and bad financial decisions can make or break your business. An accountant must have a bachelor’s degree, but they’re not required to have a certification or license. Accountants perform bookkeeping, prepare tax returns and Startup cpa profit-and-loss statements, and financial and tax planning. CPAs can help with tax planning and tax filing, including state and federal income tax returns, payroll tax returns, and sales and use tax returns. CPAs must keep up their tax and accounting knowledge with continuing education each year in order to stay licensed, so they’re always up to date with the most recent tax laws and changes.

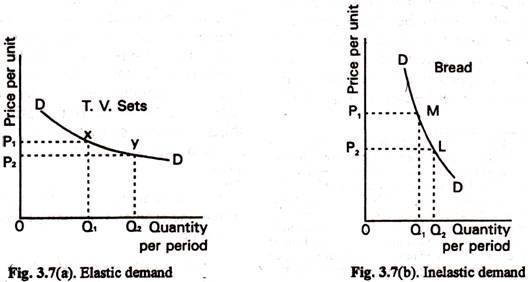

CPA is typically calculated on a per-transaction basis, while CPC is usually calculated on a per-click basis. This means that CPC can be more accurate when measuring the effectiveness of an ad campaign, as it takes into account the number of people who actually click on an ad. However, CPA is generally seen as a more holistic metric, as it takes into account the total cost of acquiring a new customer.

Our dedicated finance experts will be available round the clock to help you through your startup journey. We have written a lot of articles in the past asking all the startup wonders to ditch DIY accounting and bookkeeping. That being said, CPAs are an important part of startups as they are well equipped with the nuances of accounting. In the initial phase, you can continue doing the accounting and bookkeeping yourself using excel. However, as the scale of operations increases, one needs to bring a CPA on board.